How Intelligo Would Have Picked Up On The Bernie Madoff Scandal 11 Months Before His Arrest

On December 11, 2008, financier Bernie Madoff was arrested by the FBI and charged with masterminding a long-running Ponzi scheme. Madoff would gain notoriety for running the multibillion-dollar Ponzi scheme, widely considered the largest financial fraud of all time.

Intelligo was able to find signs in legal filings and news media that Madoff was headed for trouble almost a year before he was arrested.

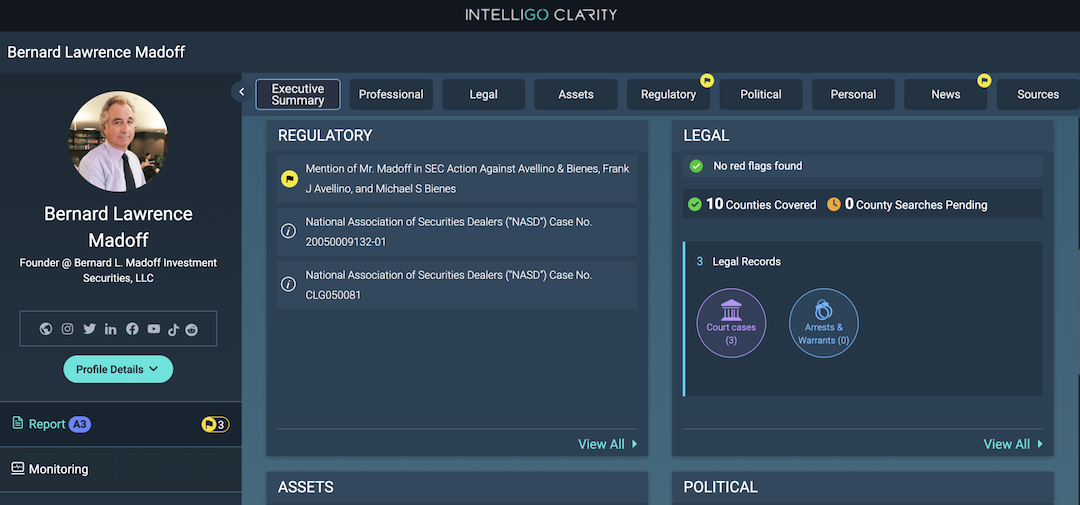

Our team of expert analysts ran a background check report as if the search was being conducted on December 31, 2007, nearly a year before his arrest, and we only had access to information leading up to that date. A look at the report shows a handful of potential indicators, both regulatory filings and news articles.

The report mentions an SEC enforcement action against Frank Avellino and Michael Bienes. In November 1992, the SEC accused the two men of selling unregistered securities. The two allegedly invested $441 million in funds they received in a discretionary trading account at a registered broker-dealer. The broker-dealer wasn’t named in the complaint, but was revealed to Madoff in an article published by The Wall Street Journal in December 1992, which was also picked up by Intelligo’s Madoff report.

In 2001, Barron’s published a story about Madoff’s hedge fund strategy. In “Don’t Ask, Don’t Tell: Bernie Madoff Attracts Skeptics in 2001,” heads of Wall Street trading desks told writer Erin Arvedlund that they were skeptical of how Madoff achieved “such stunning double-digit returns using options alone.” Some bankers confessed that they couldn’t pull client money out of Madoff’s hedge fund — his numbers were so good, they’d be fired. Intelligo’s Madoff report also flagged this article.

Finally, Intelligo’s report flagged a 1998 lawsuit Madoff filed, alleging breach of contract against Flynt Systems Corporation. The lawsuit represents yet another signal of Madoff’s propensity for dishonesty. Flynt assigned its right to receive payment of the second installment to Platinum Funding Corporation. Platinum prepared a letter for Madoff in August 1997 that claimed that the threshold to trigger the second installment was crossed and that Madoff had to pay Platinum. In spite of this acknowledgment, Madoff requested that Flynt enter into an agreement with him to acknowledge and personally guarantee that the threshold will be crossed, and that the entire project would be completed. In addition, Madoff requested that Flynt repurchase the second installment rights from Platinum to protect him from potential legal action. In other words: Madoff had falsely signed a document with one creditor, and committed a backdoor deal to resolve the issue.

Taken together, these indicators from Intelligo’s report illustrate that over time, Madoff exhibited traits of dishonesty in his business dealings, unprofessionalism in his choice of business associates, and an unusual degree of secrecy behind his strategy and apparent success.

Combining the power of AI with the insight of human experts, Intelligo provides the fastest, most comprehensive individual and company background checks on investment subjects. Stay ahead of adverse events – Sign up for a demo today.

Background checks tailored to your business needs.

Companies of all sizes, from boutique investment firms to global asset allocators, use Intelligo for all their background check and continuous monitoring needs.